estate tax changes for 2022

This course has been updated to reflect all current changes to tax law and amounts for 2022. The bad news is it will be reduced to.

Tax Day 2022 10 Tax Changes That Could Impact The Size Of Your Refund Cnet

Ad Get A Resolution for Your Tax Case with The Law Office of David Lee Rice.

. Every taxpayer has a lifetime gift and estate tax exemption amount. Unless the tax laws change the lifetime exemption will drop to approximately 62 million at the end of 2025. For this reason individuals may want to consider using any remaining gift tax exemption prior to the end of the 2021.

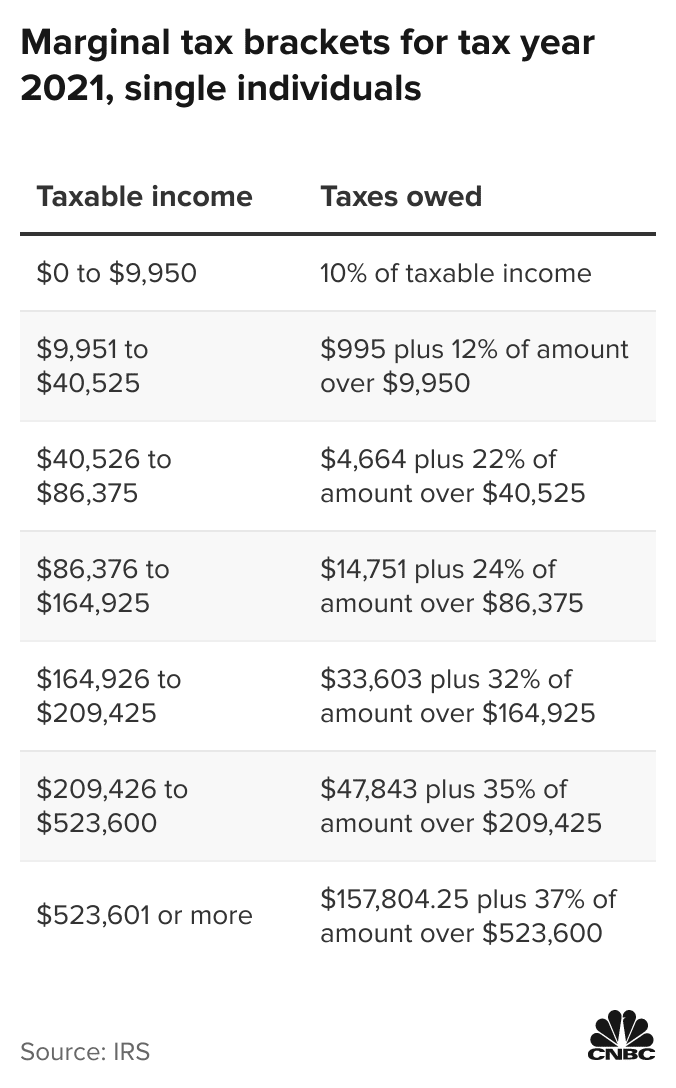

The exclusion amount is for 2022 is 1206 million. For tax year 2022 for family coverage the annual deductible is not less than 4950 up from 4800 in 2021. Fisher Investments has 40 years of helping thousands of investors and their families.

2022 Federal Estate Tax Exemption When you die your estate usually isnt subject to federal estate tax if the value is less than the exemption amount. On January 1 2026 the Federal Estate Tax Credit will automatically revert to the previous Estate Tax credit law and amounts. Due to the steep amount of the estate tax exemption only 01 of American households filed a Form 706 Tax Return in 2020.

Employer-Sponsored Retirement Contribution Limits Increase The contribution limit for elective deferrals to 401 k 403 b most 457. The annual gift exclusion increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021. Gift Tax Exclusion The gift tax exclusion amount in 2022 has increased to 16000 per individual or 32000 per married couple splitting their gifts.

In 2022 the lifetime exemption increased from 117 million to 1206 million. For those who pass away in 2022 the exemption amount will be 1206 million up from 117 million in 2021. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

However If the donor dies in 2026 the remaining 3500000 would be subject to estate taxes. In other words you can give up to 16000 to as many people as you wish without those gifts counting against your lifetime exemption. 5000000 gift will be given full credit and assuming there is no tax law change the remaining amount will be free of estate tax with a 2022 death.

Key Tax Concepts for 2022. 10000000 as adjusted for chained inflation presently 11700000 per person will be intact through the end of 2021. Estate tax changes appearing more likely in Massachusetts By State House News Service June 21 2022 Share BOSTON JUNE 21 2022The odds of estate tax reform appeared to improve Tuesday and a.

Use It or Lose It EstateGift Tax Exemption Cut in Half Effective January 1 2022. Estate taxes are designed to collect taxes from transferring property at death. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

Waiting to evaluate your estate until something changes could be a very expensive decision. Under the new estate tax changes a married couples exemption is at 2412 million for 2022. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

As of January 1 2022 the federal gift and estate tax exclusion amount as well as the exemption from generation-skipping. Thats the amount you can gift to anyone during the year whether children family or friends without reporting the gift. Changes to Grantor Trust Rules.

The Economic Growth and Tax Relief Reconciliation Act of 2001 EGGTRA scheduled a series of exemption increases starting at 675000 in 2001 and ending at 35 million in 2009 before temporarily repealing the tax entirely in 2010. 2022 Federal Estate Tax Credit. For a married couple this exemption grows to a combined exemption of 2412 million.

Note that the exemption amount doubles for a married couple. Congress would need to pass a law to extend the current. The 1206 MIL Estate tax credit will be adjusted every year for inflation until 2025.

This means that an individual can leave 1206 million and a married couple can leave 2412 million dollars to their heirs or beneficiaries without paying any federal estate tax. Here are the top estate planning law changes for 2022. If such proposal is adopted the resulting federal gift and estate tax exemption would reduce to just over 6 million as of January 1 2022.

1 In addition the top estate tax rate was lowered from 45 to 35 percent. The exemption at 1206 million this year means any amount left in your estate over this amount is subject to federal taxes. For family coverage the out-of-pocket expense limit is 9050 for tax year 2022 an increase of 300 from tax year 2021.

Under current law the federal estate tax exemption amount for 2022 is 118 million per individual but only until January 1 2026 when the exemption amounts will retroactively be placed back to where they were prior to the tax law changes of 2018. The IRS just announced important gift and estate tax changes for 2022 that youll need to know. However the deductible cannot be more than 7400 up 250 from the limit for tax year 2021.

Biden Proposed Estate Tax Change No 1. The good news on this front is that the reduction of the estate and gift tax exemption from. Estate taxes are one of the taxes covered by the IRSâs unified transfer tax system.

Lifetime Exclusion Increases to 12060000.

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Here S When Married Filing Separately Makes Sense Tax Experts Say

State Corporate Income Tax Rates And Brackets Tax Foundation

Reilly Hause Bio Site In 2022 Bio Math Math Equations

A Breakdown Of 2022 Property Tax By State

Inheritance Tax The Seven Hmrc Exemptions Everyone Needs To Know In 2022 In 2022 Inheritance Tax Tax Mistakes Paying Taxes

The Telegraph Tax Guide 2021 Your Complete Guide To The Tax Return For 2020 21 Edition 45 Hardcover Walmart Com In 2022 Tax Guide Tax Return Inheritance Tax

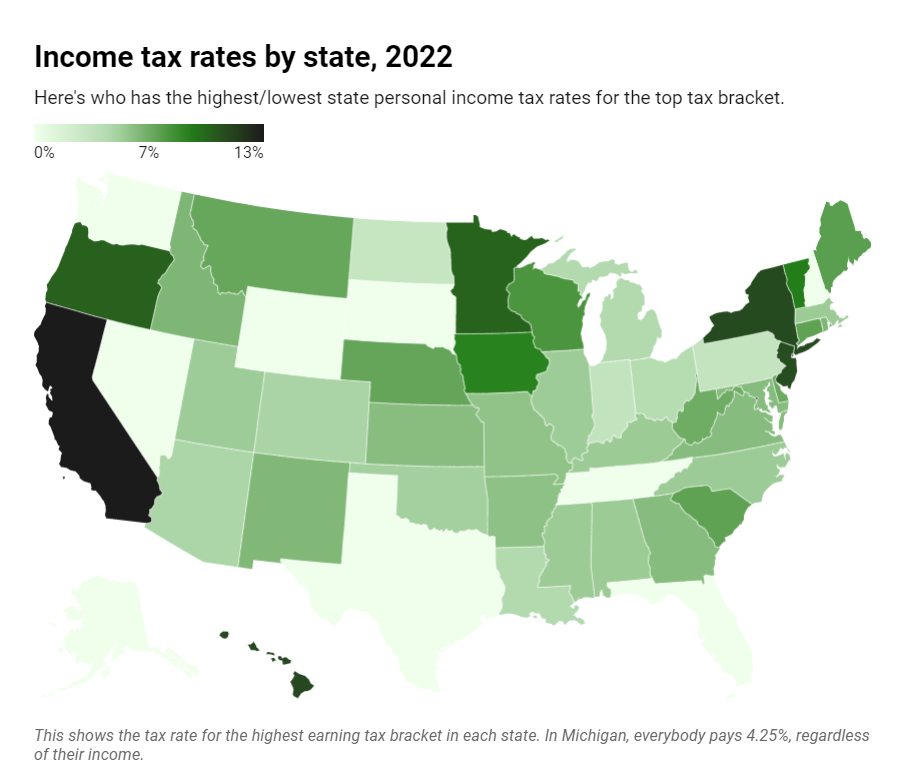

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Real Estate Newsletter April Newsletter Real Estate Marketing Email Marketing Real Estate Template Newsletter Editable

It S Not Easy To Make Big Changes In Your Life Buying A Home Is A Significant Step In Your Life Both From A In 2022 Debt To Income Ratio Preparation Misspelled Words

How To Pay Zero Taxes On Capital Gains Yes It S Legal Youtube In 2022 Capital Gain Capital Gains Tax Tax

Property Taxes Property Tax Analysis Tax Foundation

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Spring 2022 Summit Recap Austin Adventures In 2022 Estate Planning Estate Planning Attorney Continuing Education

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

2022 Updates To Estate And Gift Taxes Burner Law Group

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation